Council Tax charges

Find out how much your Council Tax is and how your money is spent

The amount of Council Tax you pay depends on which valuation band your home is in, how many people live there and if you qualify for any discounts, exemptions or support.

Find out the amount of your Council Tax for 2025-2026

2025/26 breakdown of Council Tax charges

| Band | Hart District Council (£) |

Hampshire County Council (HCC) (£) |

Hampshire Police Authority (£) |

Hampshire Fire and Rescue (£) |

|---|---|---|---|---|

| AR | 113.39 | 894.35 | 153.03 | 48.80 |

| A | 136.07 | 1,073.22 | 183.64 | 58.56 |

| B | 158.74 | 1,252.09 | 214.25 | 68.32 |

| C | 181.42 | 1,430.96 | 244.85 | 78.08 |

| D | 204.10 | 1,609.83 | 275.46 | 87.84 |

| E | 249.46 | 1,967.57 | 336.67 | 107.36 |

| F | 294.81 | 2,325.31 | 397.89 | 126.88 |

| G | 340.17 | 2,683.05 | 459.10 | 146.40 |

| H | 408.20 | 3,219.66 | 550.92 | 175.68 |

Please note that in previous years, Government legislation required the Council Tax for Hampshire County Council to be split into two separate lines – one for Hampshire County Council and one for its Social Adult Care. Due to the legislation changing this year, these two lines have now been merged together, so there is now just one line on the bill for Hampshire County Council.

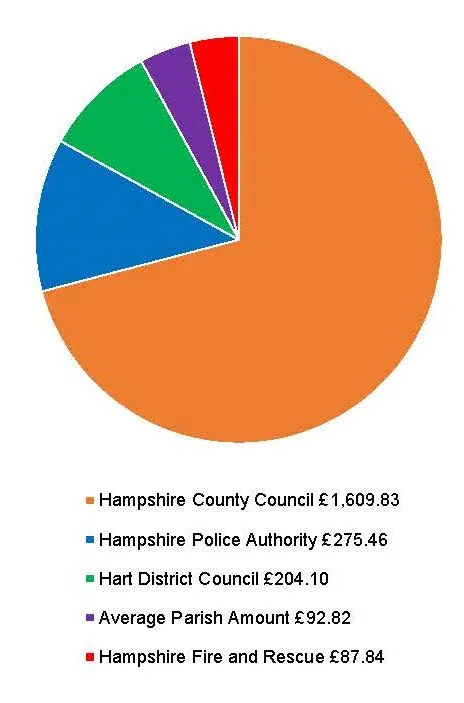

How your Council Tax is spent 2025/26

Our pie chart shows the amounts each organisation receives, based on an average band D property.

More information about how the other authorities spend your Council Tax is available at:

- Hampshire County Council Council Tax bands

- Hampshire Fire and Rescue Authority website

- Police and Crime Commissioner for Hampshire website

Parish and town council charges

You also pay a portion of Council Tax to your local town or parish council.

- View an overview of town and parish council budget information 2025/26

- View an overview of town and parish council budget information 2024/25

- View breakdown of parish budgets over £150,000 2025/26

- View breakdown of parish budgets over £150,000 2024/25